After a really weak start to the year for Xvivo Perfusion (-40%), without any clear corporate event motivating the development, we now include the stock in the Model Portfolio Opportunity.

Strong technology in a growing market

XVIVO Perfusion is a leader in organ preservation, with a technology that doubles the time lungs can be kept fresh for transplantation – from under 5 to over 10 hours – improving logistics, organ utilization and survival. Lung transplants in the US are growing, and the company is well positioned to capture market share. Although Q1 is expected to show subdued growth compared to the previous year, it is historically a weak quarter and comparative figures are high.

Strong future prospects with new organs in the pipeline

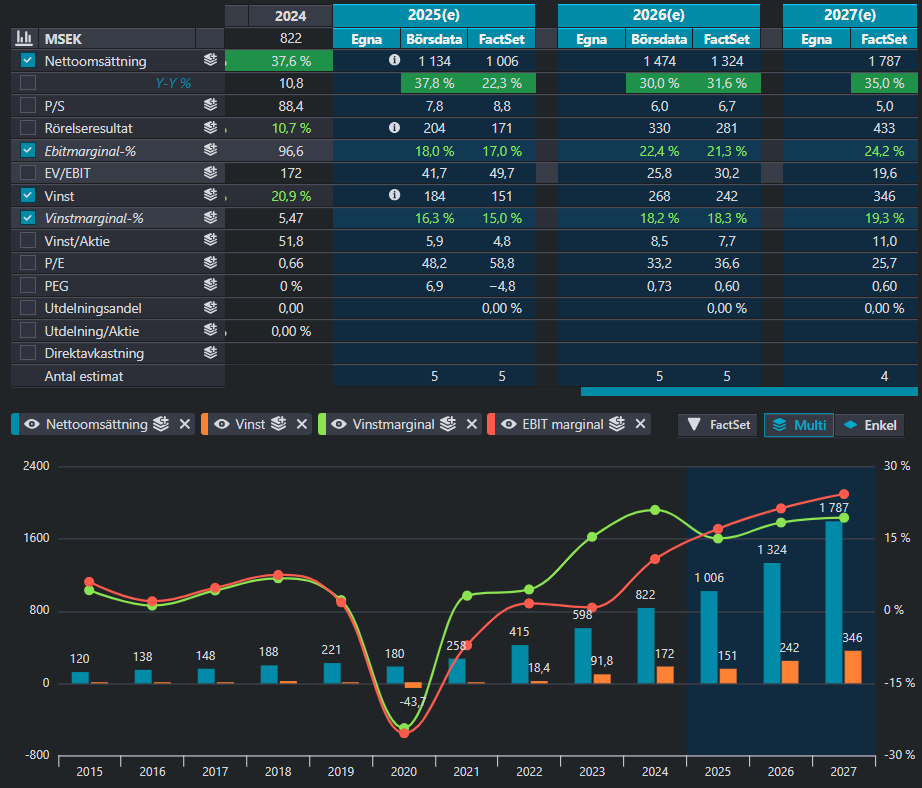

The company has already achieved two important milestones for 2025: Continued Access Approval (CAP) for the heart technology in the US and record-breaking approval to start a liver study. This opens up new revenue streams as early as Q2. Sales are expected to increase significantly in 2025–2027, and the company has the potential to reach its long-term EBITDA margin of 30 %. Cash flow is positive and investments are focused on building the sales team in the US.

Unattractive price development opens up opportunities

The stock has fallen 40% % so far this year without any negative news, which creates an attractive position to include the company in our model portfolio. Two important triggers lie ahead: a potential CE approval in Europe for the heart technology, and new study data from the European heart study to be presented in Boston in April. We believe that the market is undervaluing the company's long-term potential. The company is not cheap but is growing nicely with good profitability. The stock is now trading at EV/EBIT 50x 2025e, 30x 2026e and 20x 2027e.

I can highly recommend the interview the CEO did with the Paretopodden recently. https://podcasts.apple.com/se/podcast/b%C3%B6rsm%C3%A4klarna/id1755582652?i=1000701001430