Why US stocks?

Johan Widmark

The reason the US keeps winning

The usual arguments for why investors should be positive about US stocks usually include:

- Democracy

- The dollar as the world's reserve currency

- A strong legal system

- The country's military power

- An entrepreneurial culture

- Etc.

Unique geographical conditions

Geography is the hidden superpower that makes America so unique. The country has natural advantages over all other countries that enable American companies to get goods to market more cheaply and efficiently, key factors behind the country's economic success.

Mississippi River

5-10x

than road transport

Fertile farmland

America's best farmland is strategically located around the Mississippi River system, making it possible to produce and export food at low cost.

The United States is the world's largest food exporter and supplies twice as much as the second largest, Germany.

The United States is the world's fourth largest country by surface area, after Russia, Canada and China. But unlike the United States, most of those countries' surface area is not productive land.

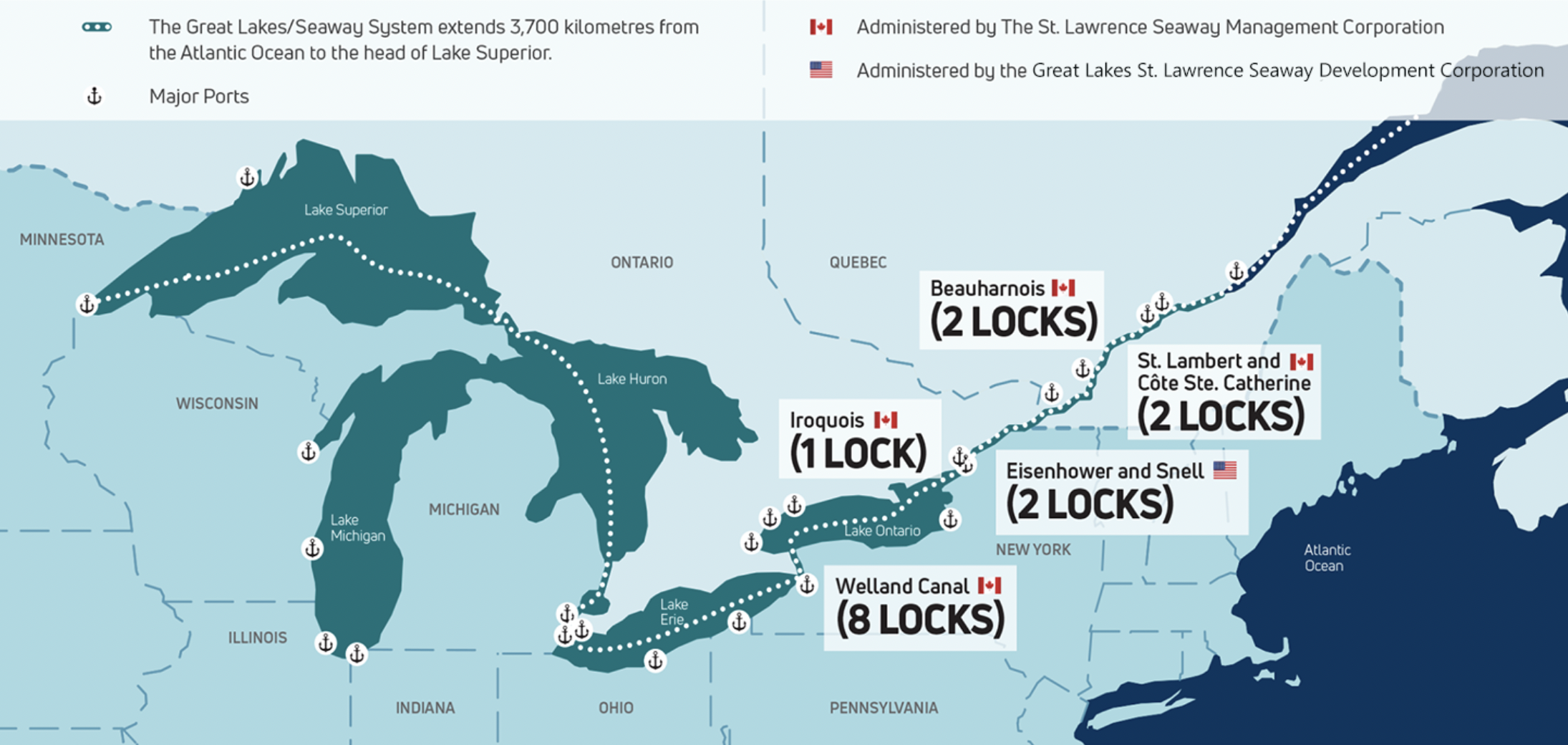

The Great Lakes and the coast

The Great Lakes are the world's largest freshwater system and are connected to both the Mississippi River at Chicago, and to the Atlantic Ocean. This means that a number of large inland cities function as port cities, which further facilitates exports and trade.

Similarly, the East Coast with the Barrier Island System acts as a protected virtual river for maritime transport from Texas to Rhode Island.

Again, American goods reach the market cheaper than those of competitors.

Natural harbors and coastline

4x

than all of Africa

America has first-class natural harbors (and harbor areas) on the world's two largest oceans.

Such as New York City, Chesapeake, Puget Sound, Los Angeles and San Francisco Bay.

These are also well connected by roads, railways and waterways to industrial areas.

US coastline (133,000 km, according to World Resources Institute) is also 4 times longer than Africa's (30,500). In part, this is because Africa has few inlets and large bays.

The USA also has 3 times longer coastline than Europe.

A longer coast also means controlling more of the sea within the country's exclusive economic zones.

This is significant because 99% of international trade (measured by volume) is via ships.

Resources and energy

No. 1

oil and gas

The United States is rich in natural resources and energy, which provides another advantage in the global market.

- Oil: The USA is the world's largest oil producer and in 11th place in terms of reserves.

- Natural gas: The USA also tops the production of natural gas and is in 4th place in reserves.

- Renewable energy: With great opportunities in wind and solar power, the country is well positioned for a greener future.

Thanks to abundant domestic energy resources, American companies can produce efficiently and competitively.

The right side of the ocean currents

The ocean currents rotate perfectly for the US.

The East Coast of the United States receives warm and humid air from the tropics, which is excellent for forestry and agriculture.

California's farmlands feed America thanks to an ideal climate—even though San Diego is at the same latitude as Egypt.

Canada on the other hand is too cold to have really productive farmland, and also has fewer rivers.

"Never bet against America"

- Warren Buffett

All in all, there is much that speaks for a continued stronger economy in the United States compared to the rest of the world. This does not mean that it will always be right to own American companies, but it is worth keeping in mind every time you as an investor set out to make an assessment of the American economy.

Read more here

Changes in Model Portfolio Opportunity: NOVO_B in, ALLEI out + Opportunity up 20.6% this year

We are now making two changes to Model Portfolio Opportunity, as we buy Novo Nordisk in anticipation of a long-term bottom and take out Alleima. Opportunity is now up 20.6% so far this year.

Clas Ohlson (in Model Portfolio Quality) surges >15% on the report – strong end to record year

Clas Ohlson, which is part of the Quality Model Portfolio, exceeded expectations by a wide margin. The share surged >15% on the news and is now trading at 7.5% FCFyield. “We are well positioned to continue creating value,” said CEO Kristofer Tonström in today's conference call.

Billion-dollar order for Ovzon from FMV – Shares rise +40% | Model portfolio Opportunity (+15% this year)

Ovzon, which is part of the Opportunity Model Portfolio, has received an order worth SEK 1.04 billion, the company's largest order ever, from FMV for a

Get news about research and portfolio changes

Contact

Disclaimer

This marketing document has been issued by Incirrata AB. It is not intended to be distributed to, published for, made available to or used by individuals or legal entities that are nationals or residents of any state, country or jurisdiction where applicable laws and regulations prohibit its distribution, publication, making available or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is for informational purposes only and shall not be construed as an offer, a solicitation or a recommendation to subscribe, purchase, sell or hold any security or financial instrument or to enter into any other transaction, such as the provision of investment advice or services, or as a contract document. Nothing in this document constitutes investment, legal, tax or accounting advice or a guarantee that any investment or strategy is suitable or appropriate for an investor's specific and individual circumstances, nor does it constitute personal investment advice to any investor.

This document reflects information, opinions and comments from Incirrata AB. at the time of its publication, which are subject to change without notice. The opinions and comments expressed by the authors in this document reflect their current views and may differ from conclusions in Incirrata AB's services or products, or third parties, who may have reached other conclusions. Market valuations, terms and calculations stated here are estimates only. The information provided comes from sources believed to be reliable, but Incirrata AB does not guarantee its completeness, accuracy, reliability or timeliness. Historical performance does not provide an indication of or guarantee of current or future performance. Incirrata AB assumes no responsibility for any loss arising from the use of this document.