Changes in Model Portfolio Opportunity: NOVO_B in, ALLEI out + Opportunity up 20.6% this year

We are now making two changes to Model Portfolio Opportunity, as we buy Novo Nordisk in anticipation of a long-term bottom and take out Alleima. Opportunity is now up 20.6% so far this year.

Clas Ohlson (in Model Portfolio Quality) surges >15% on the report – strong end to record year

Clas Ohlson, which is part of the Quality Model Portfolio, exceeded expectations by a wide margin. The share surged >15% on the news and is now trading at 7.5% FCFyield. “We are well positioned to continue creating value,” said CEO Kristofer Tonström in today's conference call.

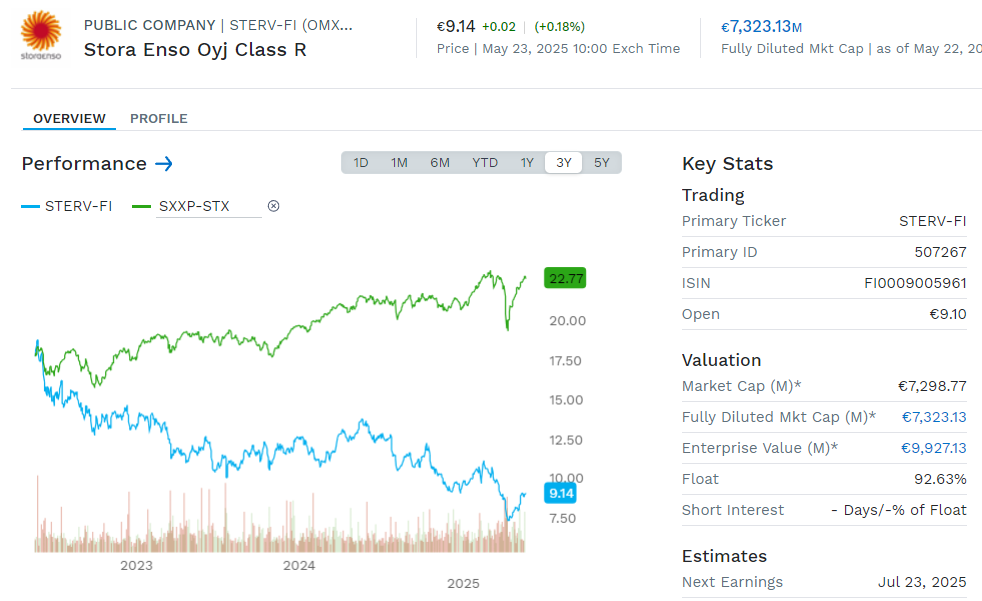

One part of our case in STORA ENSO is about to play out

Stora Enso sells 175,000 hectares of Swedish forest Finally, the news we've been waiting for has arrived: Stora Enso is selling part of its forest. Stora Enso is selling 175,000 hectares of its Swedish forest land – equivalent to 12.4 % of its total holdings – for an EV of EUR 900 million, or approximately SEK 9.8 million. It is […]

New shares in Model Portfolio Quality, up 5.3% this year | Opportunity up 7.2% this year

After some strong price movements and reports, we are now replacing some of the shares in the screened model portfolio Quality. The changes are therefore due to some shares in the portfolio no longer meeting the criteria and therefore leaving, while some new names that do so are entering the portfolio. Lundin Gold is leaving the portfolio, after a […]

More report reactions: DYNAVOX +26%, XVIVO +7%, NOTE -4%, MYCRONIC -4%, OVZON +2%

The reports are thundering in from Incirrata's portfolio companies with DYNAVOX +26% and XVIVO standing out on the upside while NOTE -4% is disliked by analysts and is forced to leave the portfolio.

Report comment COOR, GETINGE and ALLEIMA

Coor impresses, Alleima bounces while Getinge fell back on weak order intake. At the same time, our Model portfolios continue to outperform the index so far this year.

Xvivo into Model Portfolio Opportunity

After a really weak start to the year for Xvivo Perfusion (-40%), without any clear corporate event motivating the development, we are now including the stock in the Model Portfolio Opportunity. Strong technology in a growing marketXVIVO Perfusion is a leader in organ preservation, with a technology that doubles the time lungs can be kept fresh for transplantation – from under 5 to over 10 hours […]

This week's most important: Lundin Gold highlights increased dividend | Truecaller | Bitcoin volatility | Stora Enso

This week's most important: Betsson, Coor, Dynavox, Biogaia, Model Portfolio Quality +9% YTD

Strong start to the year for our Model Portfolio Opportunity. MedCap decline weighs on Model Portfolio Quality. No fuel for quick turnaround in Evolution's report

Most important of the week: Strong January for OMX and Model Portfolio Opportunities | Quality weaker | Patience with Evolution

Strong start to the year for our Model Portfolio Opportunity. MedCap decline weighs on Model Portfolio Quality. No fuel for quick turnaround in Evolution's report