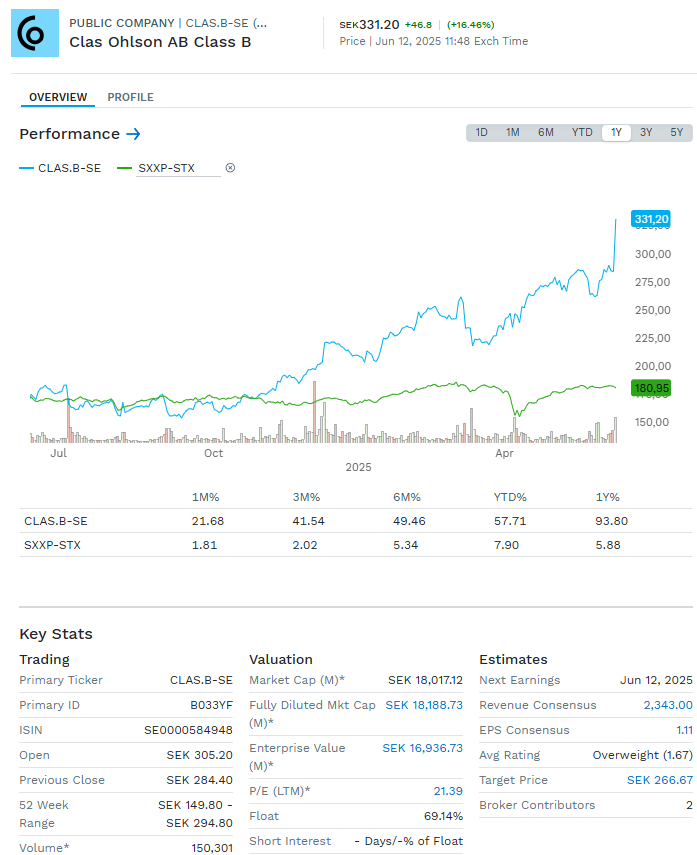

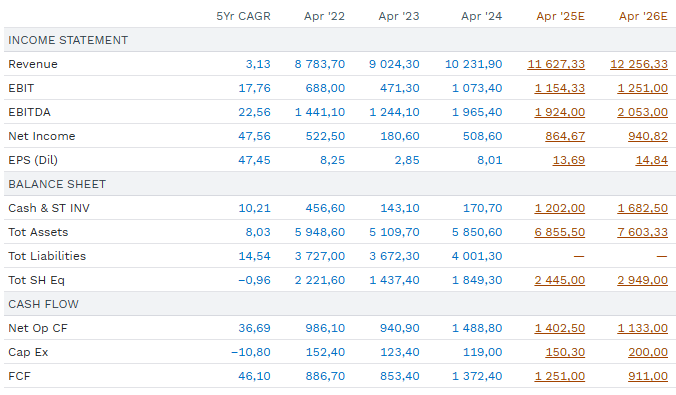

Operating margin above target – and rising

Clas Ohlson ends the year with an operating margin of 10.1 %, well above the target level of 7–9 %. EBIT for Q4 landed at SEK 109 million (65), which exceeded estimates. According to the CEO, the currency tail from the dollar's weakening has not yet fully taken effect: “We expect positive currency effects in the coming quarters – there is nothing to indicate lower margins in the short term” (conf call).

Growth drivers deliver

All five product niches are growing, e-commerce is up 19% and now accounts for 21% of total sales. The broad offering provides resilience in weak seasons: “We have grown despite cool spring weather – lawn mowers and technology products took over where fans lost out”, said Tonström. The number of Club Clas members increased by 500,000 to 5.9 million.

Top-notch cash flow – continued investment pace

Free cash flow amounted to SEK 1.1 billion and the strong balance sheet enables both a dividend (SEK 7/share) and an increased investment rate. SEK 250 million will be invested in the coming year in the store network, automation and IT. “We have a scalable, efficient platform – now we are investing to grow further and take market share”, summarized Tonström (conf call).

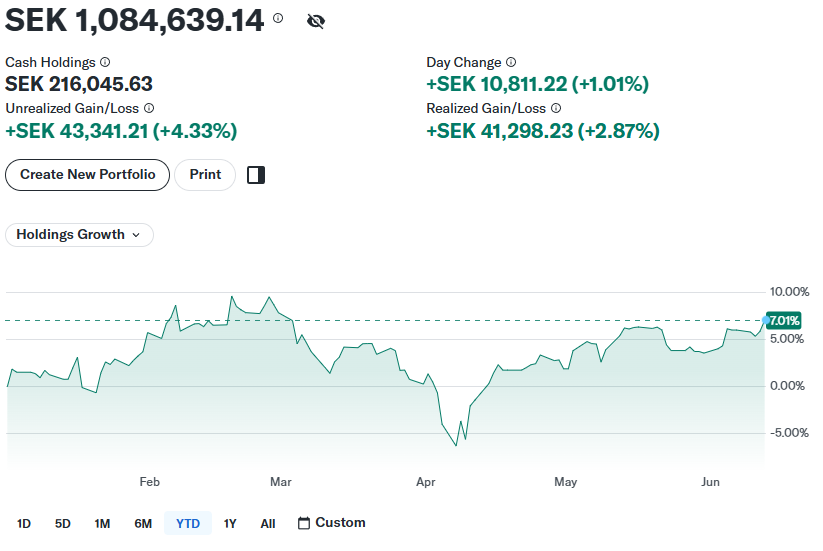

Model portfolio Quality +8.5% year to date, Model portfolio Opportunity +17.2%

Model portfolio Quality

Existing holdings +7.0%, including cash +8.5% so far this year. Read more about the portfolio, strategy and holdings here https://incirrata.se/quality/.

Model portfolio Opportunity

Existing holdings +16.0%, including cash +17.2% so far this year. Read more about the portfolio, strategy and holdings here https://incirrata.se/opportunity/