Novo Nordisk was previously Europe's largest company driven by their leading position (along with Eli Lilly) in GLP-1 for diabetes and obesity (Ozempic/Wegovy). The stock has undergone an extreme revaluation (more than halved), and is trading at a significant valuation discount to Lilly on fears that Novo will not be able to maintain its position. But it will continue to inject cash into the company, and after the bottom, I think you now have a second chance to get into a really good level before the price stabilizes towards fair value, which should be significantly higher, even if we don't expect a new ATH.

After the failed attempt to take out the 0.236 Fib level, Novo Nordisk really interesting again below 450, and that a failure to take out old bottoms below 400 could pave the way for a long-term rise towards 650, maybe 700.

Significant valuation gap against Eli Lilly (approx. 50%)

Alleima out of Model Portfolio Opportunity

We choose to withdraw Allemia from Model Portfolio Opportunity on a) low conviction b) management defections by (admittedly not the most central management personnel) both IR and HR, and c) target price reductions, most recently by ABG in the morning.

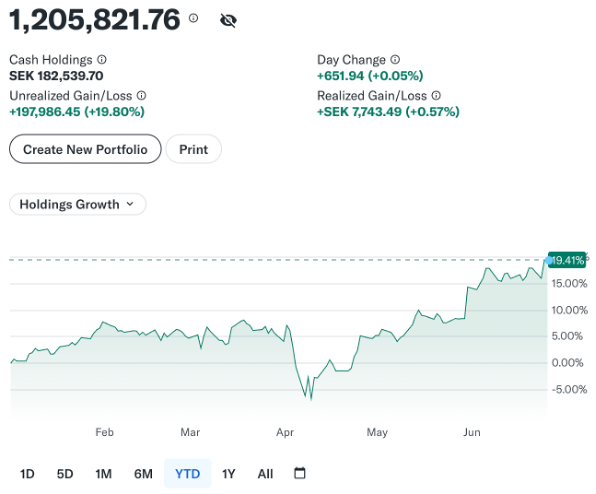

Model portfolio Opportunity up 20.6% so far this year