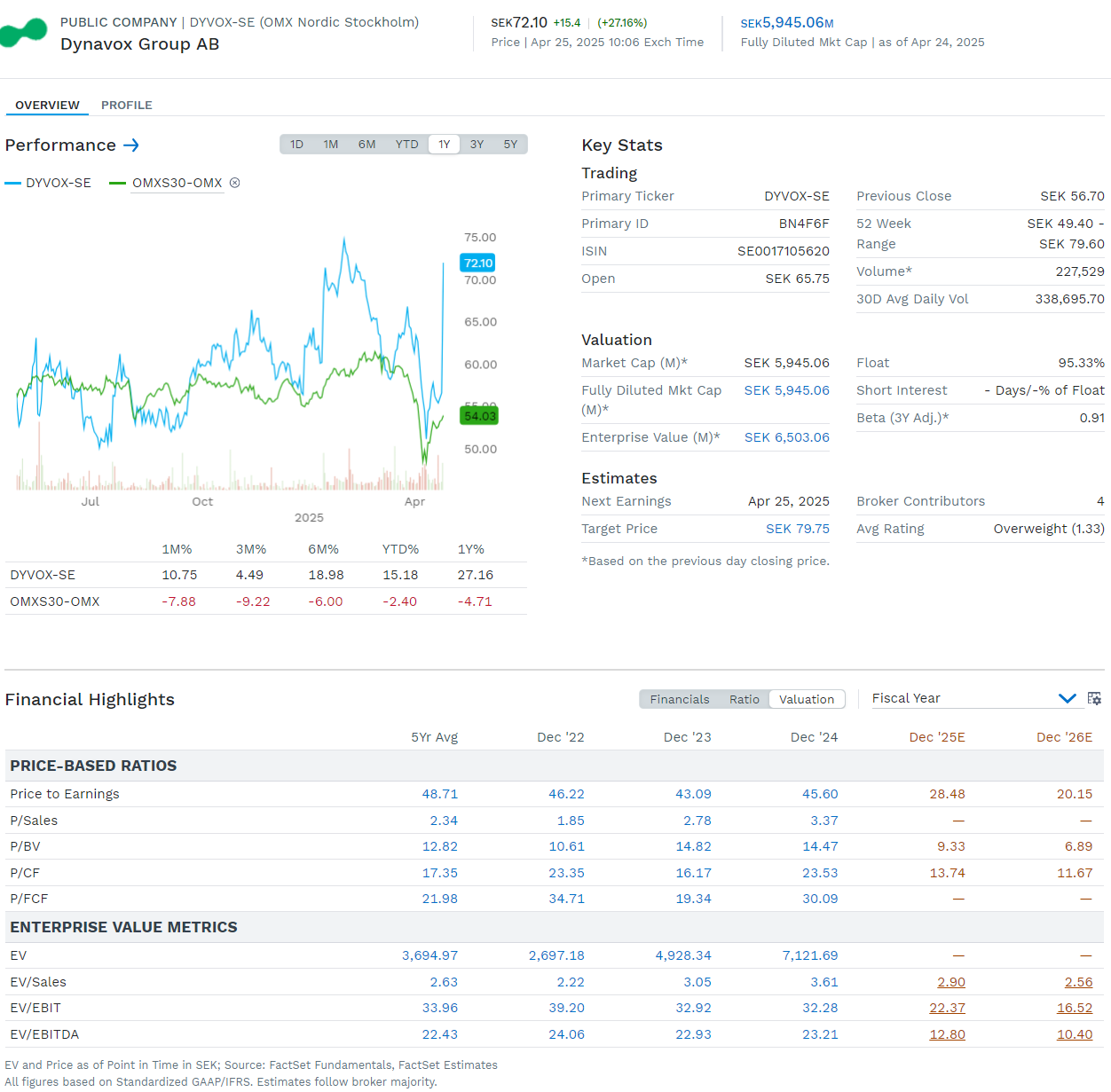

Dynavox – Strong growth and robust margins despite investments and external concerns

Dynavox delivers an exceptionally strong first quarter with 36 % sales growth (34 % in constant currencies) and an EBIT increase of 34 %. Despite significant one-off costs of 22 MSEK related to system and R&D investments, an EBIT margin of 7.3 % is achieved – almost in line with the previous year. EPS more than doubled to 0.22 (0.10) EUR, which the market has rewarded with a share price increase of +27 % since the report.

Growth was broad both geographically and across different user groups – not least the symbol-based solutions for children and young people with autism. The company’s acquisition of French distributor Cenomy further strengthens its European presence. At the same time, risks from trade tariffs and currency fluctuations are minimized thanks to medical device classification and currency-matched costs.

CEO Fredrik Ruben emphasizes that “demand remains high and confirms the strength of our business model – and we are only at the beginning of our long-term journey.”

We retain Dynavox in the Opportunity model portfolio, as the company combines a rare mix of profitability, structural growth and low cyclical sensitivity.

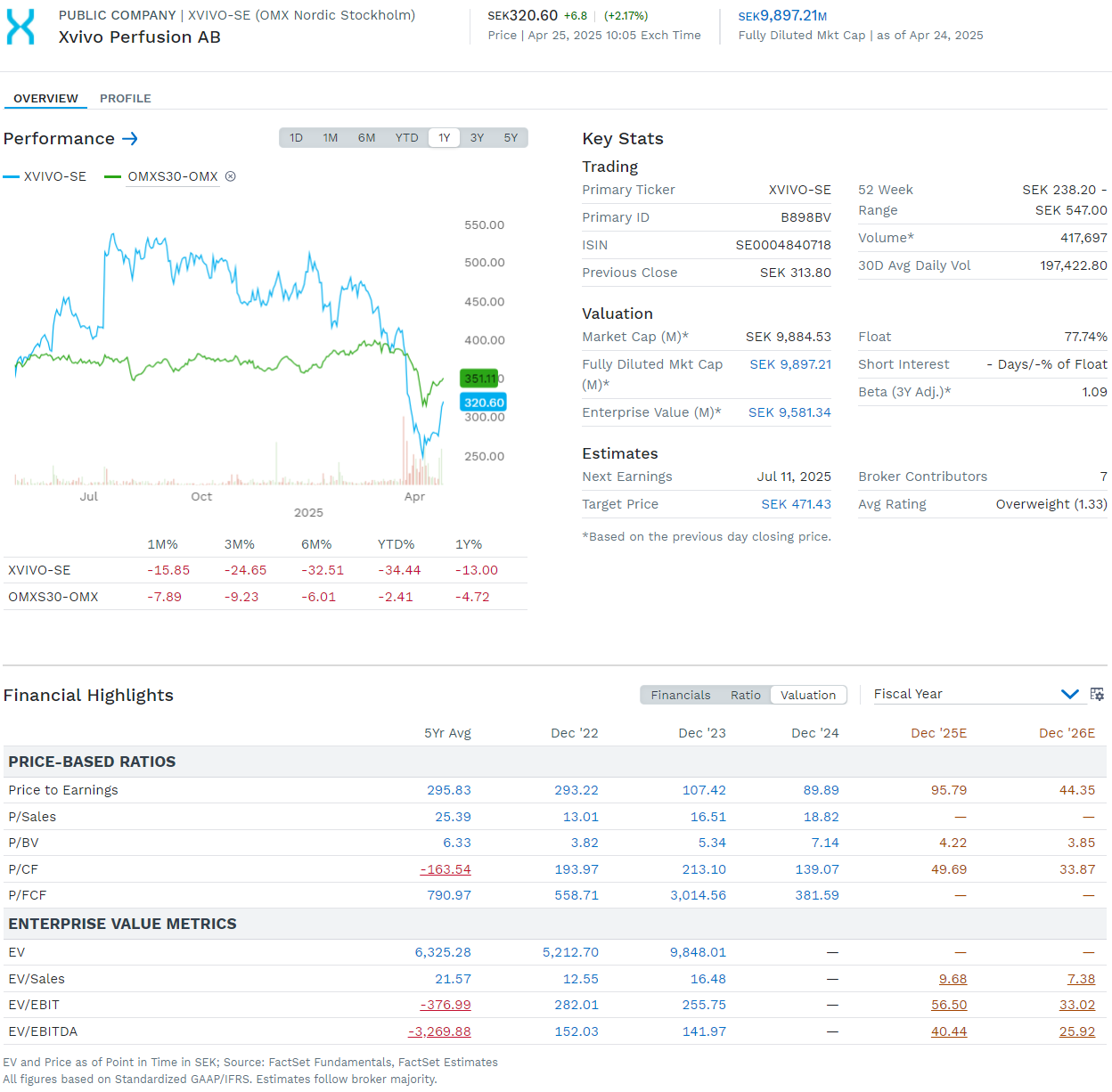

XVIVO in phase – growth conditions are strengthened in line with regulatory progress – “Very strong interest from clinics”

XVIVO delivers a Q1 in line with expectations, with 14% organic growth (CER), an EBITDA margin of 21% and several regulatory breakthroughs. Thoracic grew 16% and Abdominal 28%, while the service business declined slightly. At the same time, profitability is strengthening, with a 50% increase in adjusted EBIT.

During the quarter, IDE approval for the DELIVER study (liver), CAP for the cardiac technology in the US and Health Canada approval for liver and kidney products were received. In Australia, cardiac business grew by 60 %, and new XPS installations indicate continued high demand in lung transplantation.

The company is ramping up investments in inventory, personnel and production capacity, with the aim of increasing the volume of disposable products tenfold. These investments strengthen the conditions for growth, especially ahead of the launch of the heart product in Europe, Canada and Australia.

Our positive view is based on the fact that XVIVO is now well positioned for a new phase of commercial expansion, where scalable structures, strong clinical data and regulatory progress drive both sales and value. As CEO Rosenblad put it in the call: “We have a ready launch team, a ready plan – and very strong interest from the clinics.”

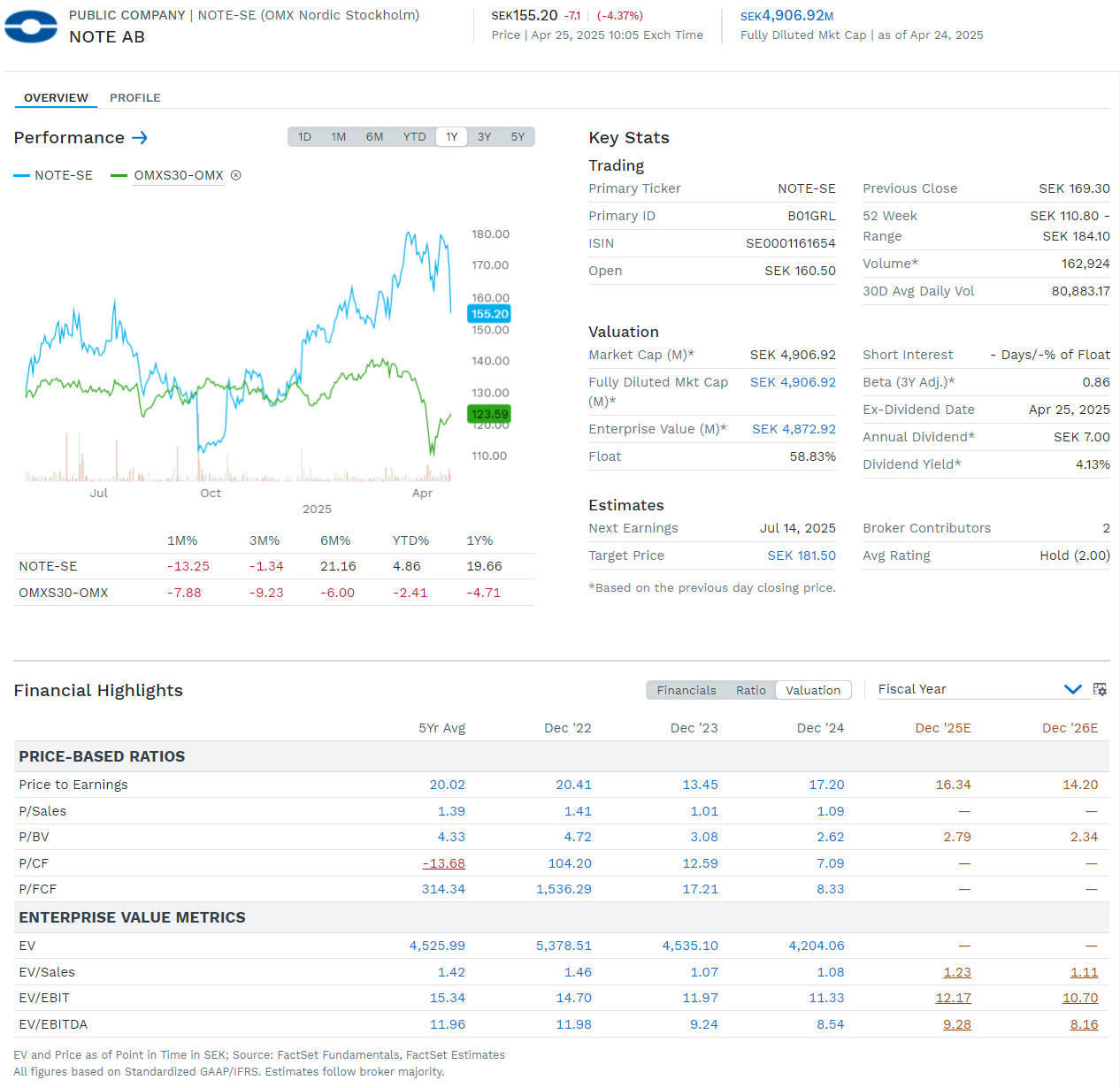

NOTE – Strong profitability in weak demand, but uncertainty dampens potential

NOTE reports a Q1 with profitability above expectations – adjusted operating margin of 10 % and a record high operating cash flow of SEK 178 million – despite continued weak demand and -5 % organic growth. Security & Defense grew 23 % and Greentech 8 %, but segments such as Communication and Medtech were weighed down by low investment willingness.

CEO Johannes Lind-Widestam emphasized during the call that the company “delivers strong profitability in a very difficult market” and that “sales will turn around – the only question is when.” At the same time, we see an uncertain macro picture, continued inventory adjustments by customers and geopolitical concerns that may hamper demand, especially in the UK and the industrial segment.

We are therefore removing NOTE from our model portfolio Opportunity. Despite a fundamentally strong company, we see a risk of negative price momentum in the near term, not least as several banks have recently lowered their recommendations. The stock deserves continued monitoring – but from the sidelines until the signals of growth turn around.

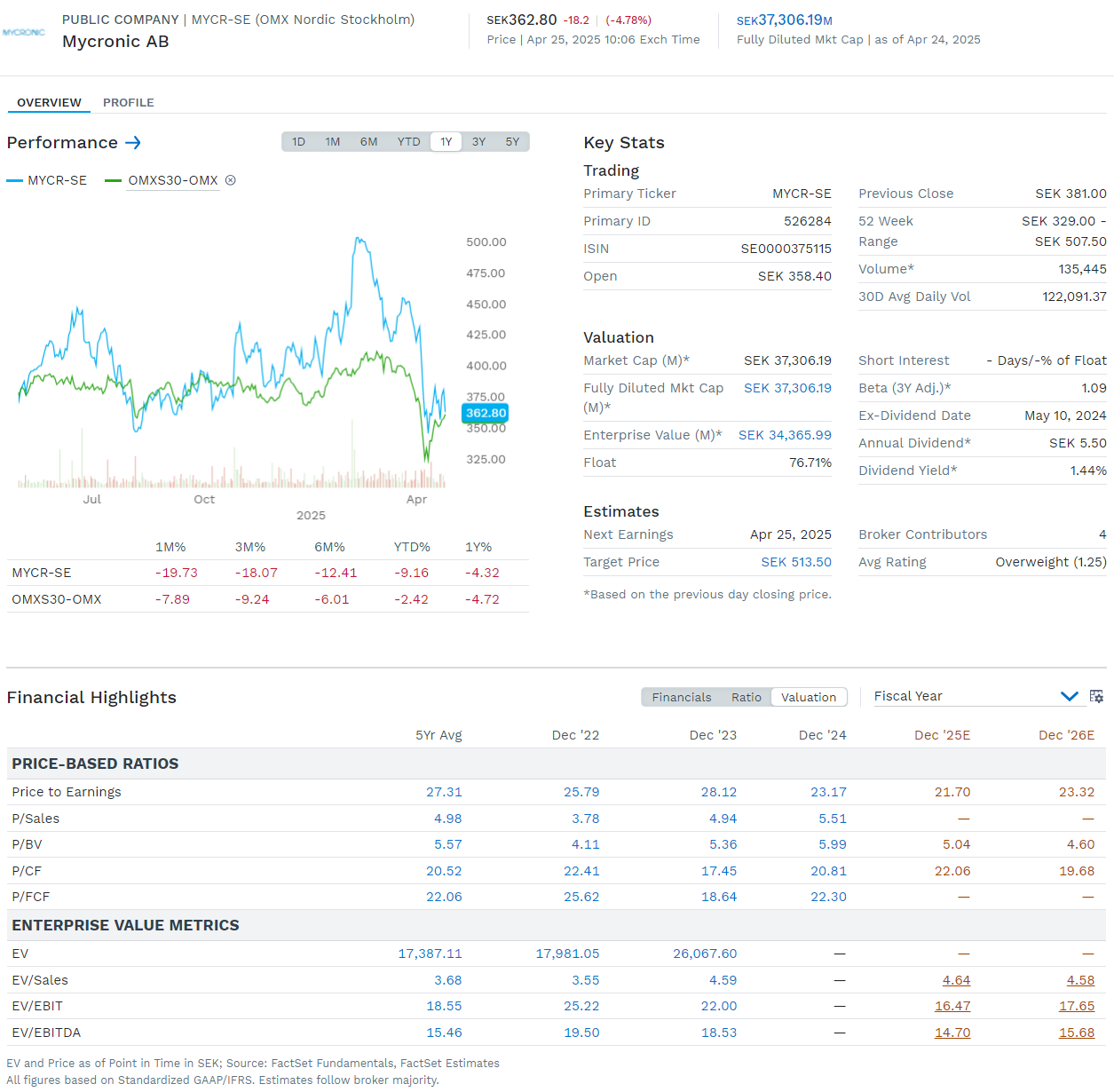

MYCRONIC – Strong quarter, but more cautious guidance in a more uncertain climate

Mycronic delivered a very strong first quarter with records in both sales (+27 % to 2.14 billion SEK), operating profit (775 million SEK) and gross margin in Pattern Generators (76 %). EPS came in at 6.36 SEK – clearly above expectations. Despite this, the annual forecast was lowered from 7.5 billion SEK to a range of 7.0–7.5 billion SEK, citing increased uncertainty linked to currency fluctuations, trade tariffs and a more cautious investment climate. The share is down about 3 % on the reporting date.

The main explanation lies in the High Flex division, where sales fell by 1.3% and operating profit was negative. When asked if the company had seen any rush of orders from the US in anticipation of potential tariffs, the CEO said on the conference call that “no, not really – we rather see the business climate being negatively affected.”

In contrast, Pattern Generators continued to deliver at a high level with high order intake (6 systems) and stable demand in both display and semiconductor. When asked about the market outlook, the CEO responded on the conference call that “we have had the opportunity to talk to many customers recently, and so far no one has changed their long-term investment plans.”

We retain Mycronic in the Opportunity model portfolio as the company continues to show strong profitability, strategically important acquisitions and a solid order book – while the company is preparing for future growth through increased R&D investments and geographical expansion in Asia.

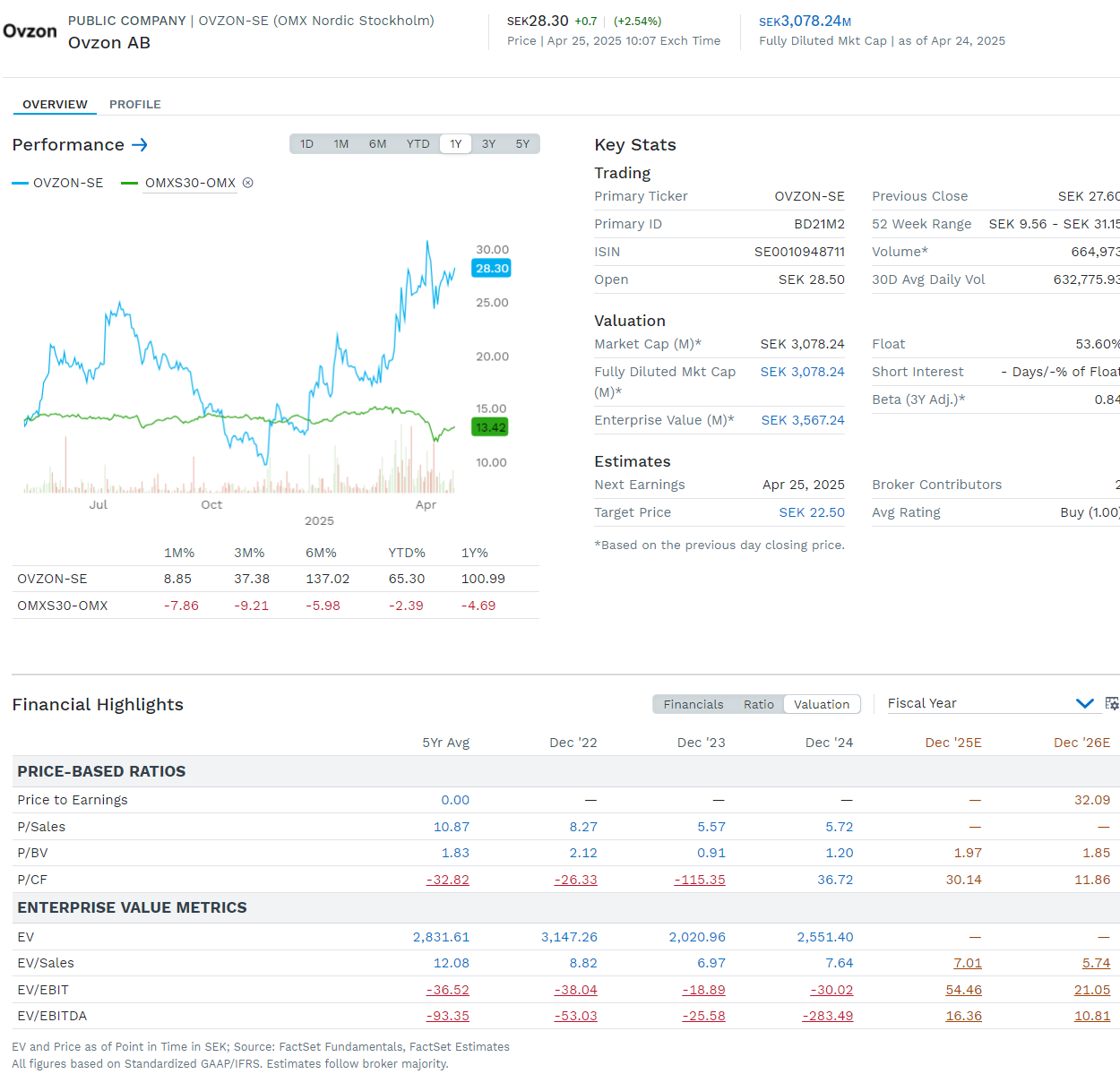

OVZON shows strength in Q1 – EBITDA turns around

Ovzon delivers a clear turnaround in Q1, with sales up 38 % to 90 MSEK and EBITDA rising to +18 MSEK from -18 MSEK last year. Operating profit improves to -16 MSEK (from -25 MSEK) and loss per share decreases to -0.03 MSEK. The share is up 2 % on the report.

Following last year's largest order ever – a 12-month contract worth SEK 185 million – deliveries have started to roll, contributing to higher utilization at Ovzon 3 and gradually stronger profitability. The EBITDA margin rose to 20 %. At the same time, the order backlog increased to SEK 250 million, even though order intake in the quarter (SEK 22 million) was low.

Demand for resilient and superior SATCOM is growing, especially from defense and emergency services. Ovzon has started deliveries to the Italian fire and rescue service and has gained a new customer from a European NATO country. A successful Arctic expedition also confirmed Ovzon 3's ability to deliver robust satellite communications in extreme environments – a requirement from NATO.

CEO Per Norén remains optimistic: “We have already demonstrated that we have the ability to scale up the business in a cost-effective manner, and will build on this foundation in 2025.” The focus going forward is on increasing capacity utilization, developing the next growth phase and distinguishing Ovzon as a strategic provider of integrated satellite communications. Therefore, we retain Ovzon in the Opportunity Model Portfolio and see a continued high long-term revaluation potential.