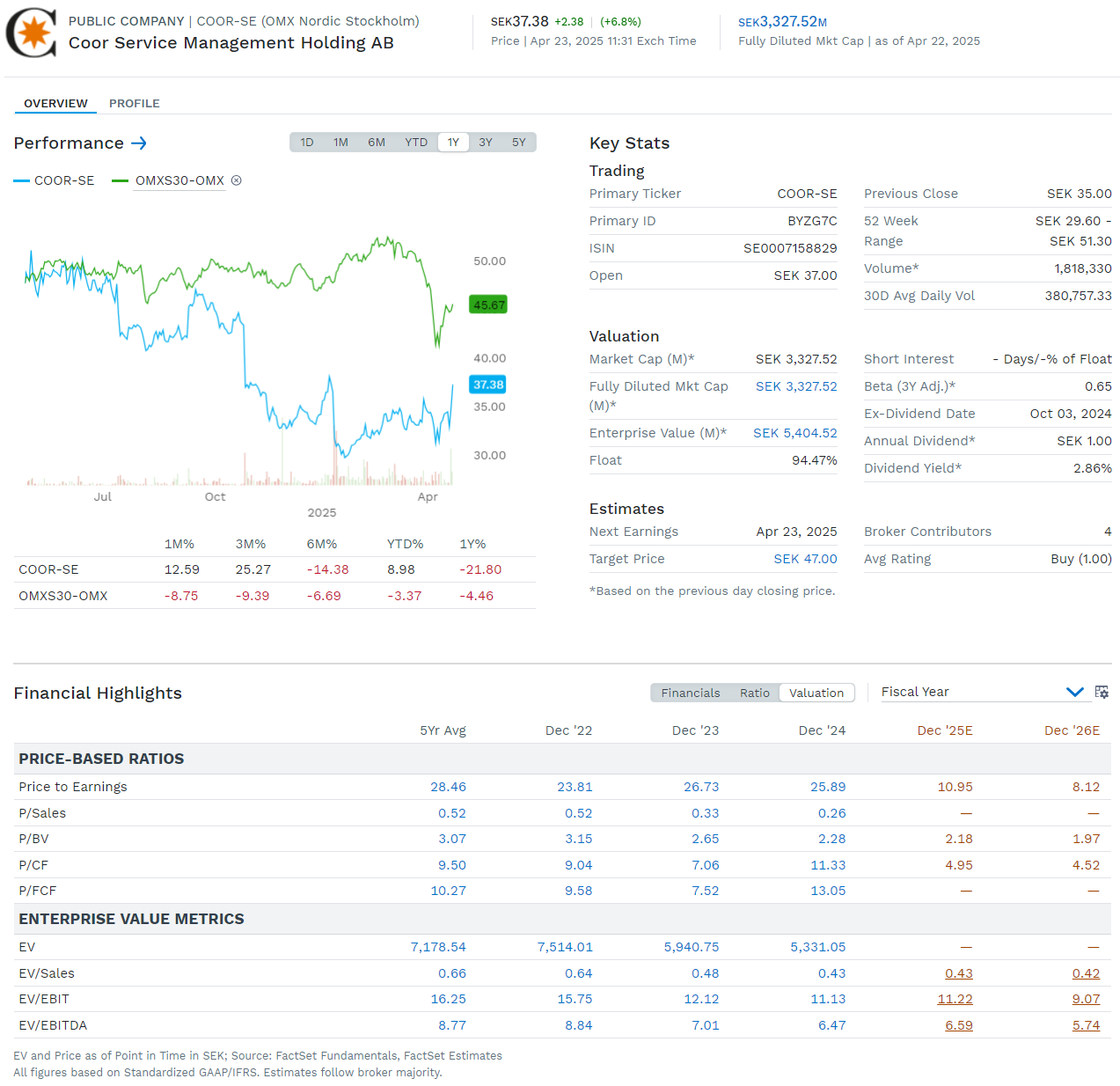

Coor: Stronger margins and cash flow in focus – the stock rises on the report

Coor (in Model Portfolio Opportunity) delivers a somewhat mixed Q1 report where revenue came in marginally below expectations (SEK 3.05 billion vs. est. 3.09), while EBITA and cash flow surprise positively. Adjusted EBITA amounted to SEK 144 m (vs. est. 104 m), driven by improved operational efficiency and cost savings from the ongoing reorganization. Operating profit also beat expectations by SEK 110 m vs. expected 90 m. However, EPS missed expectations (SEK 0.50 vs. est. 0.96), which can be partly explained by one-time costs.

New CEO Ola Klingenborg – in office for seven weeks – points to strong customer relationships, an attractive offering and good demand in the market. Despite negative organic growth (-1.8 %), he highlights, among other things, signed contracts with Equinor and Copenhagen Towers as stabilizing factors. Cash flow improved significantly after a decrease in working capital, and cash conversion reached 81 % (vs 57 % in the previous quarter). The new organization has been well received and is expected to have full effect during the first half of the year.

Management emphasizes continued focus on margin improvement rather than short-term growth, and sticks to the long-term EBITA margin target of 5.5 %. At the same time, EPS consensus shows a clear downward adjustment for 2025 and 2026, indicating remaining challenges. The share's rise suggests that the market is rewarding improved fundamentals and clear efficiency measures.

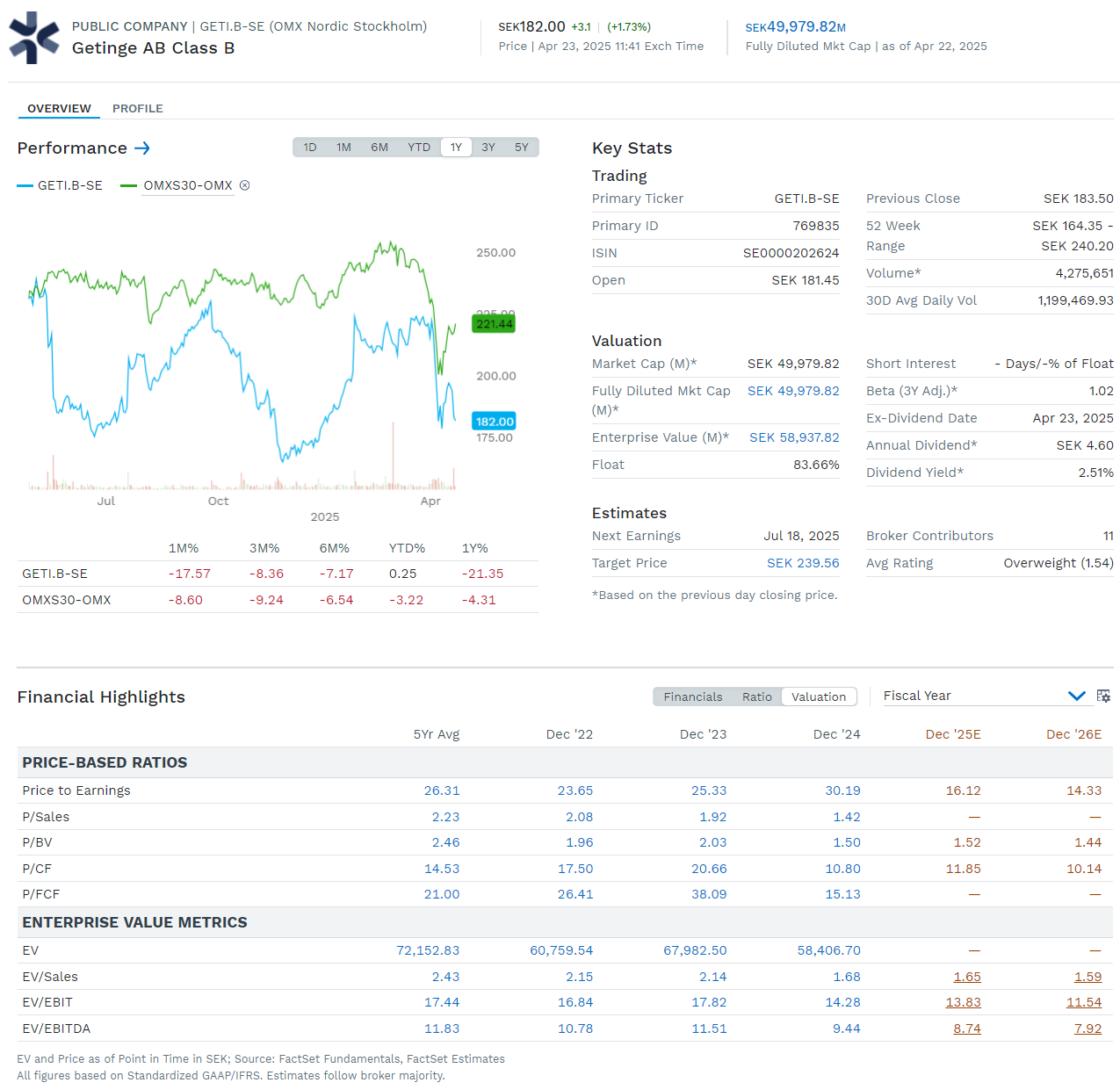

Getinge: Strong performance in core business hides weak order intake – share down despite improved margins

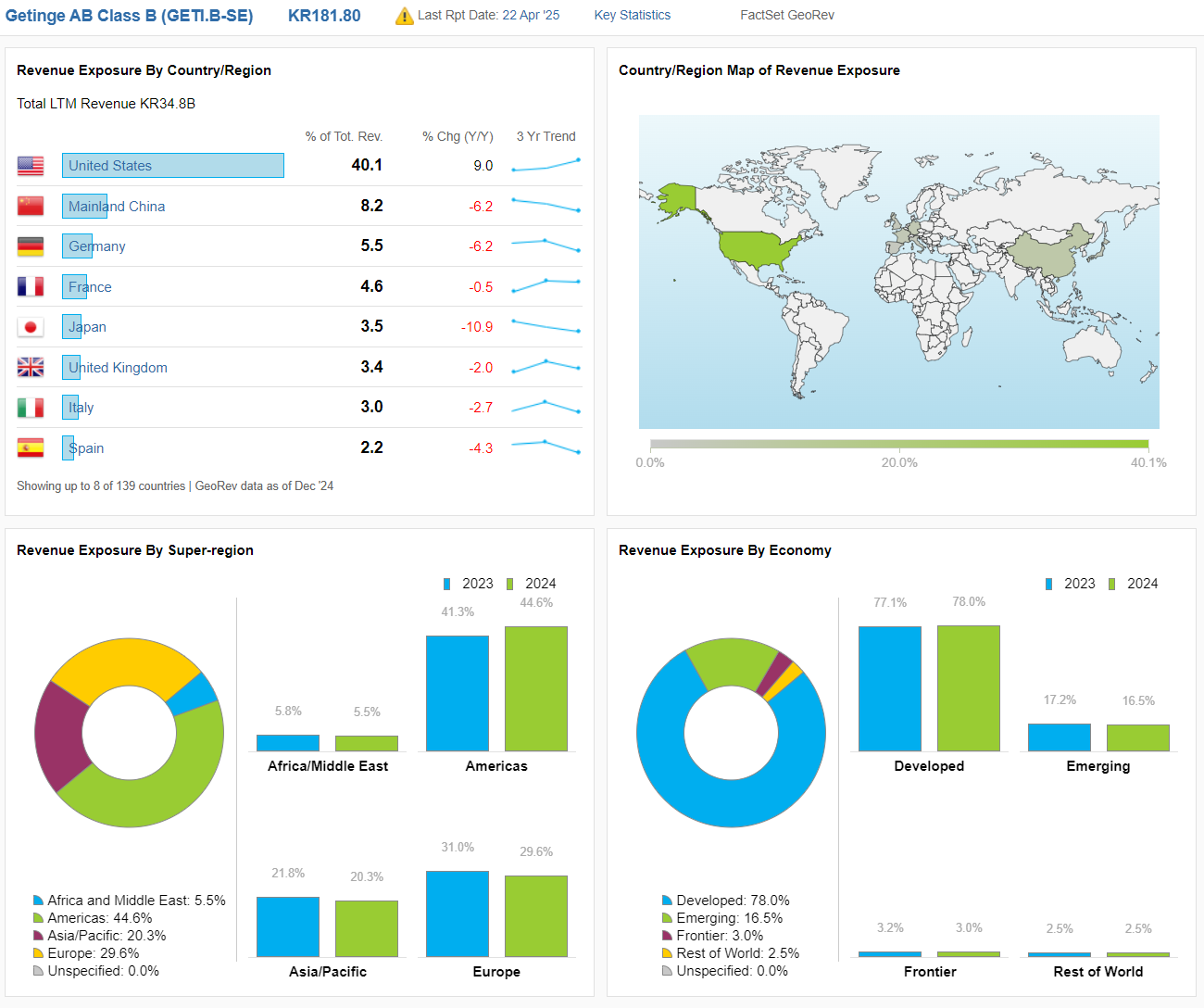

Getinge's (in Model Portfolio Opportunity) Q1 report was met with disappointment despite improved sales and profitability. The share fell ~6 % after order intake, a key indicator of future growth, only increased by 2.9 % organically – well below consensus (5 %) and a clear slowdown compared to Q4 (7.4 %). However, net sales grew by 10.7 % (organic +6.2 %) and operating margin improved to 12.1 % (11.1 %), driven by strong development in the high-margin Acute Care Therapies (ACT) business area, which includes ventilators and ECLS products. ACT delivered order intake growth of 8 %, sales +20 % and an EBITA result that exceeded expectations by 11 % – a clear sign of strength.

Headwinds came mainly from Life Science, where both sales and margins fell short of consensus, impacted by a weak bioprocess market and paused research funding in the US. Margin pressure from currency effects (-1.1 ppt) and increased inventories contributed to weak free cash flow (SEK 0.2 billion). Getinge's global footprint reduces vulnerability, but tariffs on medical technology in the US are now affecting the cost side. However, 60 % of the company's US sales are manufactured locally, which mitigates the effect.

Despite disappointments at the aggregate level, Getinge stands by its full-year forecast (org. growth 2–5 %) and is guiding long-term towards an EBITA margin of 16–19 % by 2028. The strong development in the core business ACT may restore confidence in the long term – provided that Life Science stabilizes and the impact of tariffs can be managed.

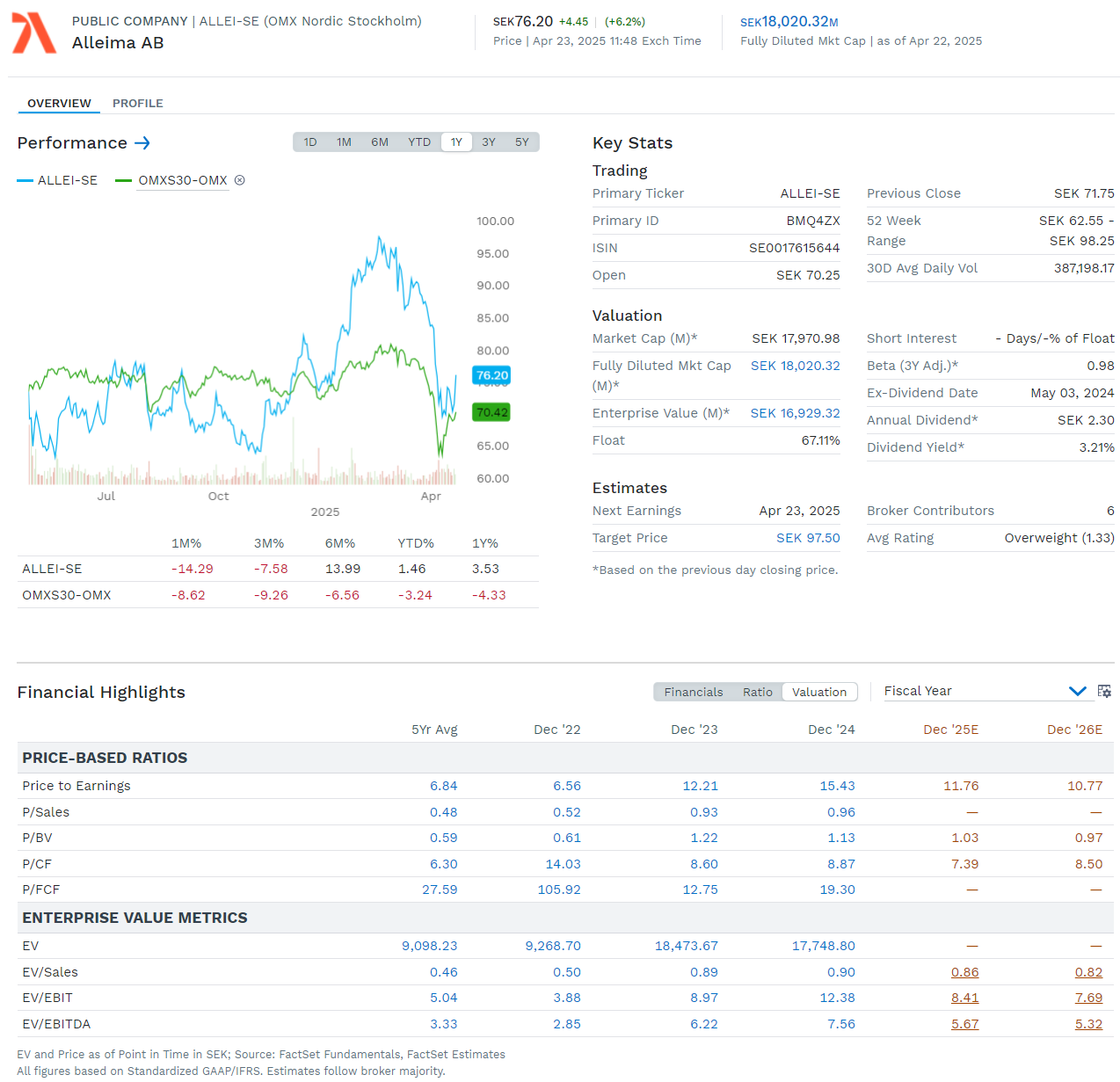

Alleima: Strong profitability despite sluggish order intake – the share rebounds after report boost

After a prolonged decline from the peak in February, the Alleima share (in the Opportunity Model Portfolio) was revived in its Q1 report, where both sales, profit and margins exceeded market expectations. Adjusted earnings per share ended at SEK 1.65 (vs. est. 1.48), revenues increased to SEK 5.15 billion (vs. est. 4.86) and EBIT beat consensus by 5 %. Despite the strong quarter, it is noted that order intake on a rolling 12-month basis decreased by 2 %, reflecting some underlying demand slowdown – especially compared to the previous year's record levels.

The company is guiding for continued stability in Q2, with an order situation described as good in several key segments. The product mix is expected to be similar to Q1, but currency headwinds may dampen results somewhat. This suggests that the company is now entering a more normalized phase, where margin discipline and strong delivery precision are becoming more important than volume growth.

The market rewarded the report with a price increase, but the question going forward is whether Alleima can continue to defend its margins in a situation where demand is leveling off and currency is having a negative impact. However, with a proven cost focus, good visibility in deliveries and a stable order book, the company has created a solid platform for the coming quarters.

Update on Model Portfolios

So far this year, our Model Portfolios are now +1.6% for Quality and +0.35% for Opportunity. It can be compared to OMXS30 which is -3.3% so far this year.

Model portfolio Quality

Model portfolio Opportunity