Strategy portfolio

Johan Widmark

We believe in growth

Incirrata's model portfolio is designed for maximum return at reasonable risk. The strategy is based on a combination of momentum, volume and fundamental analysis based on a couple of basic assumptions.

- For political and structural reasons, the Swedish krona can be expected to continue to weaken. For those who want to maintain the purchasing power of their capital, it is therefore good to have a high proportion of foreign shares.

- The US has a number of geographical, structural and geopolitical advantages that will make US companies winners in the future as well. Read more about our view of the US here.

- The last decade's asymmetrically high value creation in the technology sector is expected to continue and justifies an overweight to the sector.

- The EU has several structural, demographic and competitive challenges that justify an underweight in European equities.

- For a good spread of risk and exposure to uncorrelated returns, smaller parts of emerging markets and commodities are included.

- As inflation protection, a small amount of gold and bitcoin is included in the model portfolio.

Development

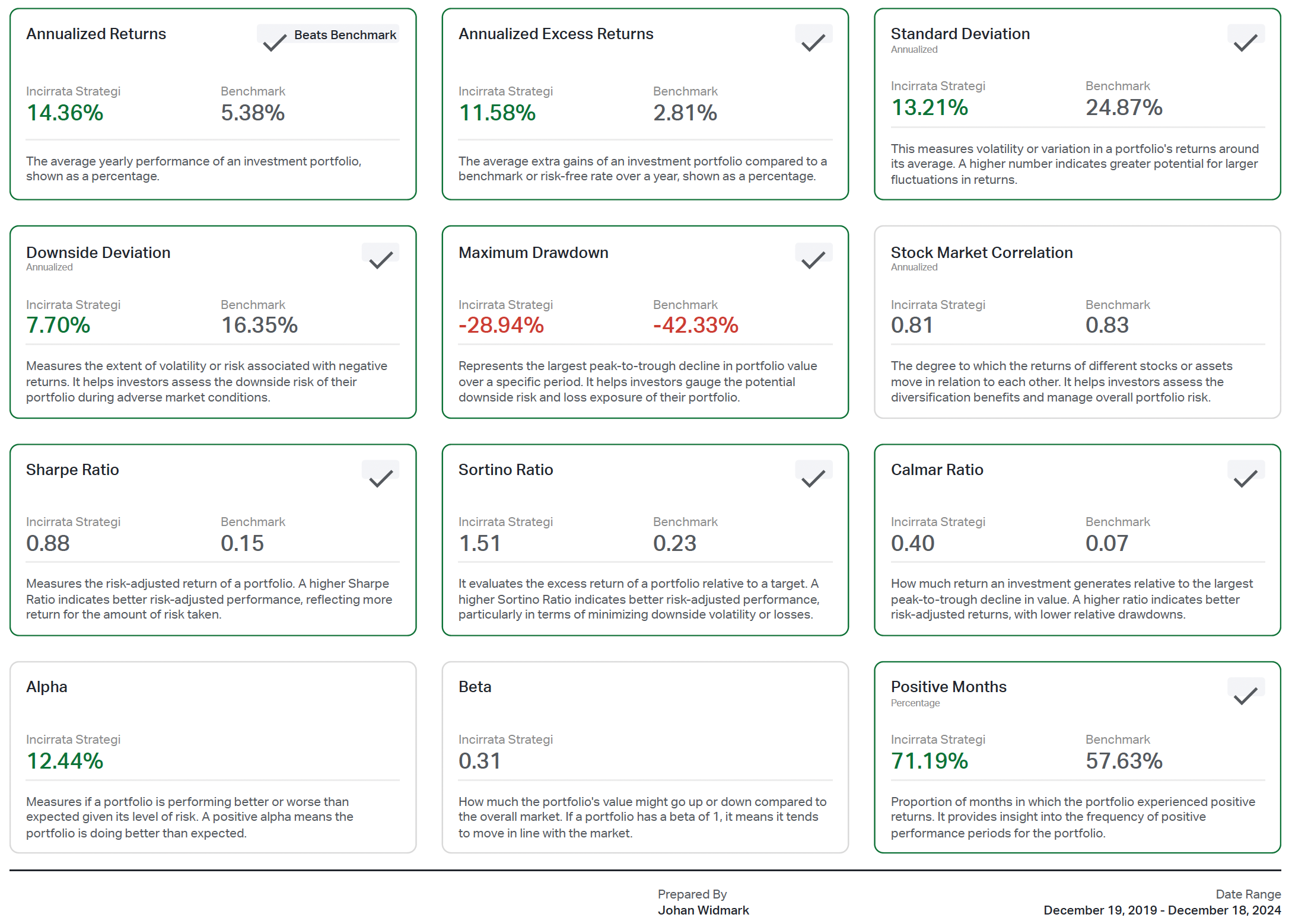

As of 19 Dec 2024, the strategy portfolio is up 96%* in five years. This can be compared with the index fund MSCI Sweden, which increased by 30% during the same period.

96%

Return 5 years, as of 2024-12-19,

compared to 30% for MSCI Sweden

Good risk-adjusted return

0,88

with 0.33 for Avanza Zero

The Sharpe ratio measures the risk-adjusted return for a portfolio. A higher Sharpe ratio indicates better risk-adjusted performance and reflects higher returns for the risk taken. The strategy portfolio's Sharpe ratio of 0.88 can be compared with one of Sweden's most popular funds Avanza Zero at 0.33.

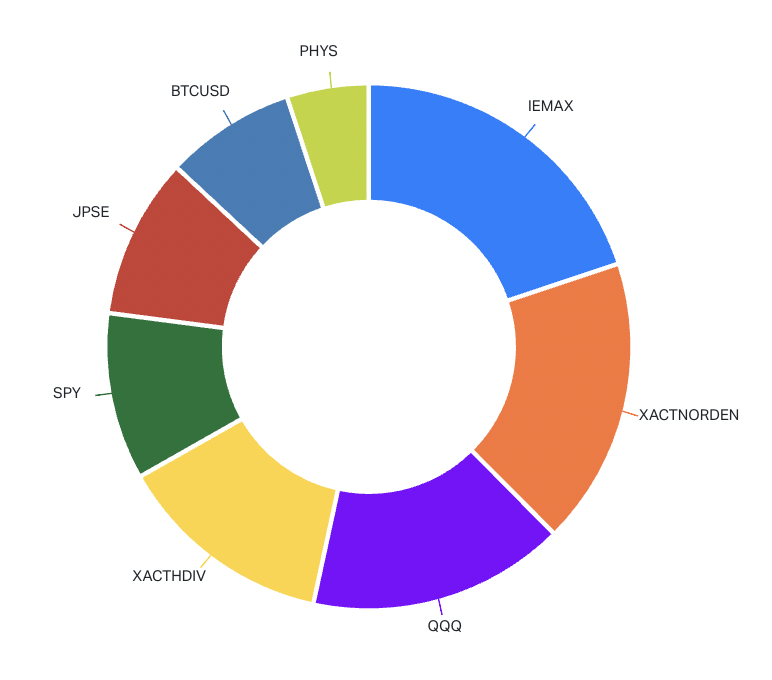

Distribution

35%: USA distributed among selected funds with exposure to Nasdaq 100 (15%), S&P 500 (10%) and US small companies (10%).

20%: The Nordics in selected broad funds.

20%: Emerging markets in selected fund.

15%: Nordic dividend shares in selected fund.

5%: Gold in selected fund with physical assets, not producers.

5%: Crypto assets, Bitcoin respective Crypto Top 10 by Virtune.

71%

Positive months

Read more here

Changes in Model Portfolio Opportunity: NOVO_B in, ALLEI out + Opportunity up 20.6% this year

We are now making two changes to Model Portfolio Opportunity, as we buy Novo Nordisk in anticipation of a long-term bottom and take out Alleima. Opportunity is now up 20.6% so far this year.

Clas Ohlson (in Model Portfolio Quality) surges >15% on the report – strong end to record year

Clas Ohlson, which is part of the Quality Model Portfolio, exceeded expectations by a wide margin. The share surged >15% on the news and is now trading at 7.5% FCFyield. “We are well positioned to continue creating value,” said CEO Kristofer Tonström in today's conference call.

Billion-dollar order for Ovzon from FMV – Shares rise +40% | Model portfolio Opportunity (+15% this year)

Ovzon, which is part of the Opportunity Model Portfolio, has received an order worth SEK 1.04 billion, the company's largest order ever, from FMV for a

Get news about research and portfolio changes

Contact

Disclaimer

This marketing document has been issued by Incirrata AB. It is not intended to be distributed to, published for, made available to or used by individuals or legal entities that are nationals or residents of any state, country or jurisdiction where applicable laws and regulations prohibit its distribution, publication, making available or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is for informational purposes only and shall not be construed as an offer, a solicitation or a recommendation to subscribe, purchase, sell or hold any security or financial instrument or to enter into any other transaction, such as the provision of investment advice or services, or as a contract document. Nothing in this document constitutes investment, legal, tax or accounting advice or a guarantee that any investment or strategy is suitable or appropriate for an investor's specific and individual circumstances, nor does it constitute personal investment advice to any investor.

This document reflects information, opinions and comments from Incirrata AB. at the time of its publication, which are subject to change without notice. The opinions and comments expressed by the authors in this document reflect their current views and may differ from conclusions in Incirrata AB's services or products, or third parties, who may have reached other conclusions. Market valuations, terms and calculations stated here are estimates only. The information provided comes from sources believed to be reliable, but Incirrata AB does not guarantee its completeness, accuracy, reliability or timeliness. Historical performance does not provide an indication of or guarantee of current or future performance. Incirrata AB assumes no responsibility for any loss arising from the use of this document.