The Nasdaq has swung over 2000 points in less than two weeks. In 2021 when risk appetite was at its peak, with SPACs, NFTs, etc., it took a year to climb 3400 points. So the volatility is here and there will be brilliant opportunities to get into good cases at good levels, and to go wrong of course.

While I expect a peak in the US later this year, there are also signs that the dollar may peak out, creating a double headwind in the short term for Swedish investors in the US.

One way to hedge your portfolio against a weak USD is to have exposure to commodities. I continue to believe in Lundin Gold as a strong bet in this environment (which now looks to be setting a new high).

This week, the reports start rolling in with Ericsson on Friday morning before opening. Then Alleima will present its report at 11:30.

Right so far from Incirrata's first lunch seminar

Last week we had our first lunch seminar about the markets, which will become a recurring event every other Thursday at Incirrata's office on Östermalmstorg.

Then, when OMXS30 stood in the middle of the 2470-2650 range in which it had traded for most of 2024, I showed this roadmap, among other things, and emphasized that I did not believe that OMX would need to test the channel bottom again before breaking out.

That turned out to be correct and today OMX broke out on the upside (assuming we close above 2650). Will probably need to retest 2650 from above, and likely MA200 around 2550, before further upside.

Given the stocks we talked about, Atlas Copco, BioGaia, SOBI and Mycronic performed strongly in the strong market. Evolution is still weak, Coor has not recovered after the profit warning, is setting new lows and will likely be weak until the report on February 6, which may then clarify what will happen with the dividend.

New cases in the works – this time Ovzon

Some stocks I am taking a closer look at, and will look for good entries in, are Surgical Science, Acast and Ovzone.

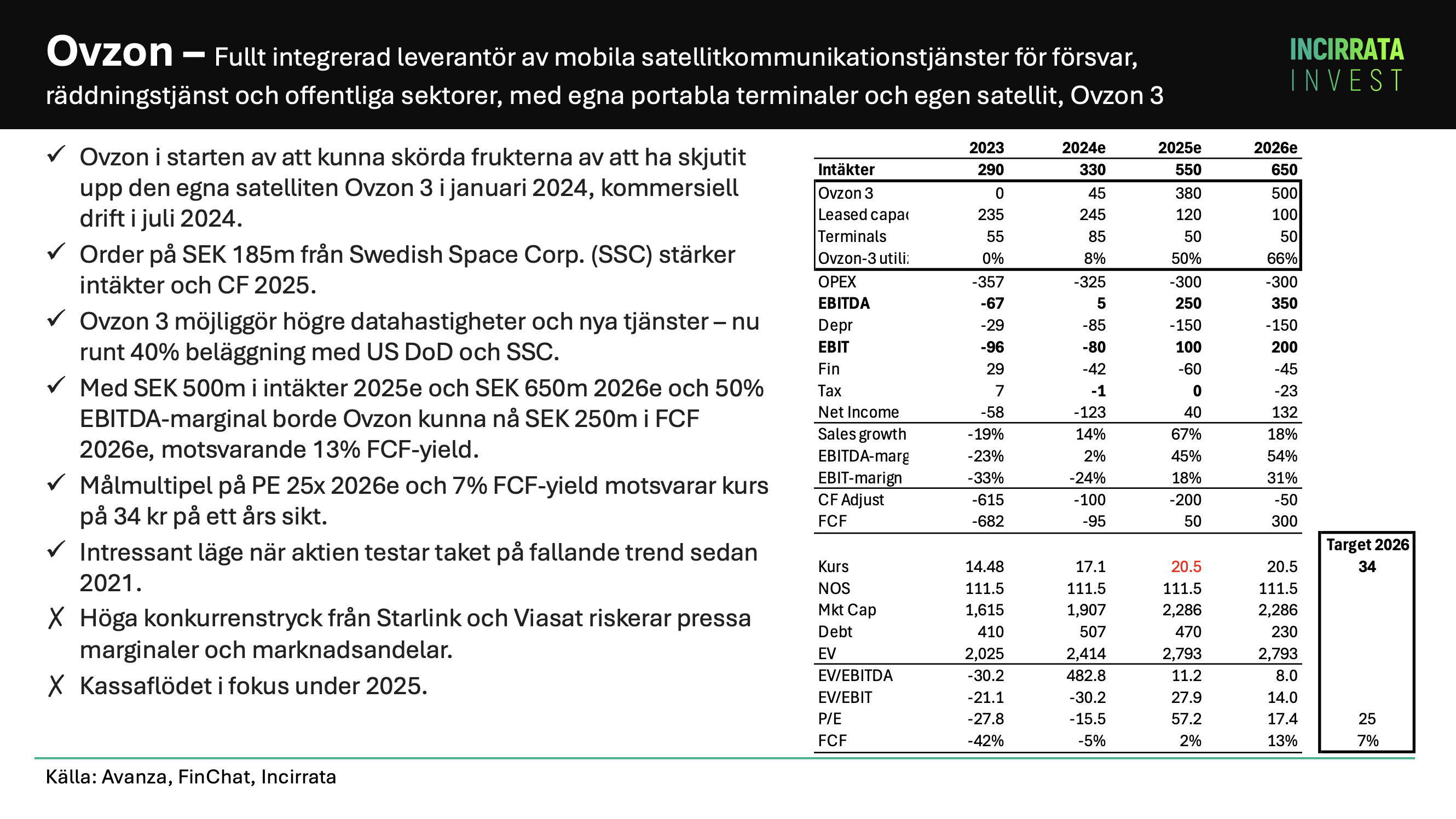

The case in Ovzon is that the company is now at the beginning of being able to reap the benefits of having launched its own satellite Ovzon 3 in January 2024, in commercial operation in July 2024.

At the end of last year, the company received an order of SEK 185m from Swedish Space Corp. (SSC) which was a welcome addition, and strengthens the outlook and cash flow for 2025.

Ovzon 3 enables higher data rates and new services – with the orders from the US Department of Defense and SSC, occupancy should approach 40%.

With an estimated revenue of SEK 500m in 2025e and SEK 650m in 2026e and a 50% EBITDA margin, Ovzon should be able to reach SEK 250m in FCF in 2026e. This corresponds to a 13% FCF yield at today's price.

With a target multiple of PE 25x 2026e and 7% FCF yield, the price corresponds to SEK 34 in one year's time.

Structurally, however, the company is in competition with both Viasat and, to some extent, the more consumer-focused Starlink, which risks squeezing margins and market share. And with large loans, cash flow will be in focus in 2025.

In terms of price, the stock is in an interesting position as it is close to testing the ceiling of the long downward trend since 2021.

Don't miss the next lunch seminar

The next lunch seminar about the market will be held at Incirrata's office at Östermalmstorg 5, 1st floor, Thursday, January 30 at 12 noon. Give me a shout and I'll book a spot for you!